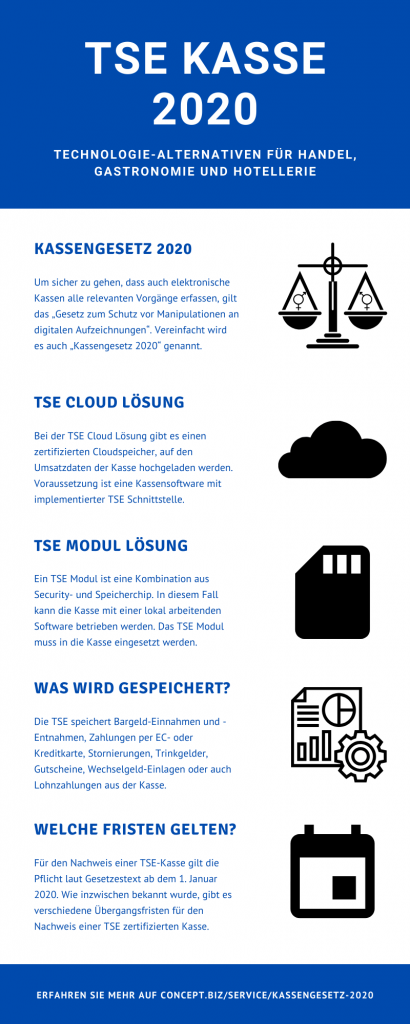

No business transaction without a receipt: Anyone who records income and expenditure with a till must keep proper records. To ensure that electronic POS systems also record all relevant transactions, the “Law for the Protection against Manipulation of Digital Records” applies. It is also known as the “Cash Law 2020“. The federal government has defined what is required for all POS systems that are used in restaurants, shops or hotels, for example:

- Certified Technical Security Equipment (TSE): The POS systems are to be protected against manipulation via a security module, a secured storage medium and a digital interface. This leads to the important question for businesses of whether new systems may have to be purchased in order to comply with the new rules. You can read more details on this in the following.

- Reporting duty: Every business that uses a POS system must report the technologies used to the responsible tax office. Those who acquired their POS system before 1 January 2020 were originally supposed to have completed the notification by 31 January 2020. In the meantime, transitional periods apply, which we explain below.

- Receipt Obligation: A receipt must be issued to the customer for each individual cashier transaction. This receipt can be issued either in paper form or, if the customer agrees, electronically. The obligation only relates to the issuing of the receipt, the customer does not have to take the receipt with them. Anyone who considers the receipt obligation to be unreasonable, e.g. because of a large number of individual receipts for very small amounts, can apply for an exemption from the obligation.